“Where is the money coming from?”

This is probably THE MOST important question in DeFi that most investors don’t ask.. 👇 🧵

Lenders, stakers, and liquidity providers receive a % reward (APR) from DeFi protocols in exchange for depositing their coins. But where are these yields and promised APRs really coming from?

Many projects are built on unsustainable ponzinomics backed by inflationary tokens. It’s important to identify projects with TRUE revenue sources, where much of that revenue goes to token holders (i.e — you).

Here are some examples of real revenue in DeFi:

Trading fees for LPs

Transaction Fees for Services

Options premiums / Insurance premiums

Borrower interest

Trading Fees

Fees paid by traders for the ability to trade between a pair of assets.

These fees go to those who are providing liquidity for the pair (i.e — LPs).

LPs earn their APR from:

Incentivized Rewards (unsustainable)

Trading Fees (real)

A lot of the APR comes from the incentivized rewards portion. These rewards are funded through token inflation and are not sustainable. There is no external revenue backing these rewards.

Trading fees, on the other hand, are real revenue. Users are paying a trading fee for the service provided by LPs.

@traderjoe_xyz and a few other DEXes take a trading fee of 0.3%.

@Uniswap has a trading fee between 0.01% & 1%.

Note that in Uniswap’s case, none of this revenue accrues to UNI holders. All of it is distributed to LPs.

So even though @Uniswap has handled over a trillion $ in trading volume, none of the fees go to UNI token holders.

Key takeaway: Revenue is important, but ultimately you’re looking for the token to accrue value from the revenue. (Example: through distributions to holders or token burns)

Protocol Fees

These are fees paid to a protocol in exchange for providing a service.

Examples:

Bridging fee: Bridges move funds from one chain to another, and they charge users for this service.

Fund management fee: @iearnfinance’s yVault’s takes a 20% performance fee and a 2% management fee for the service of managing funds. (same as hedge funds)

Platform fees for NFT Marketplace: NFT marketplaces like @LooksRareNFT match a seller with a buyer and facilitate the transaction. LooksRare takes a 2% platform fee from every NFT sale (except private sales)

@LooksRareNFT has made $500M+ worth of revenue since its launch at the start of the year. This is real money that people have paid for the platform’s service.

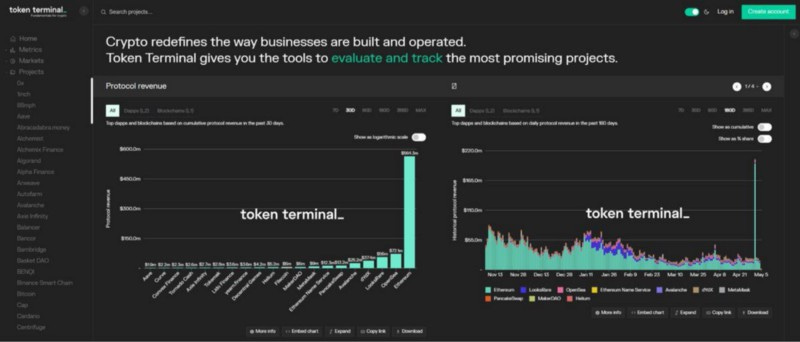

You can check out analytics like this for free on @tokenterminal.

Borrow Interest

Interest from borrowers is also real revenue, though most of it goes to lenders. The actual $ that the protocol gets to keep and share with token holders = interest from borrowers — interest paid to lenders

Unsustainable Yields / Traps

Now, let’s look at examples of protocols without real, sustainable revenue.

Here are some sources of unsustainable yield in DeFi and some common traps that you could fall into when evaluating a protocol.

Inflationary Yields

Which is bigger? A pizza with 6 slices or a pizza with 10 slices? Neither — it’s the same bloody pizza. Just divided into more slices.

Inflationary Yield Example 1: Incentivized farming rewards in LPs

Farming rewards are just tokens being printed and distributed at the cost of inflation. Rewards from issuing new tokens are not “real” yield.

You can potentially earn $ from them by farming and dumping short-term, but they are not real or sustainable sources of yield. Make sure to have a reward harvesting strategy if you farm for inflationary token rewards

Reward Harvesting Strategies for Yield Farmers

A short guide on reward harvesting strategies for Yield Farmers...0xilluminati.com

Inflationary Yield Example 2: Inflationary staking yield

The average rate of supply inflation for the top 25 PoS tokens is around 8%. (Source)

Staking yields come from:

New token issuance (supply inflation)

Transaction fees (real)

See why it can get tricky to identify how much is real revenue?

Unknown expenses

Expenses can be both off-chain and on-chain, which makes it hard to evaluate cash flows. Revenue by itself doesn’t give you a full picture of the money flow. It’s just one number to be viewed with the context of the broader picture in mind.

Imagine trying to value a business based only on revenue, without knowing how much money the business spends.

WeWork makes billions of $ in revenue — sounds awesome! … until you find out it SPENDS even more billions of $ every year = billions of $ in losses 😞

What you should look for is how much value from the revenue is going to the token. In most protocols, some portion of the revenue goes back to token holders. Protocol Revenue coming back to token holders is almost like dividends paid to shareholders of stocks.

Unsustainable revenue

Some revenue sources are not sustainable.

For example: Anchor used to subsidize borrowing through inflationary rewards to attract more borrower demand.

The rates fluctuated but there was a period where you could actually get paid for borrowing.

Borrowers had to pay 20%, but they also received 27% as incentivized rewards in ANC tokens.

Great for borrowers, but not as much for ANC token holders.

And when these rewards dry up:

→ borrowing demand plummets ↓

→ revenue plummets ↓

A couple more smell tests:

🚩 Revenue that is completely reliant on new token buyers

🚩 If the protocol doesn’t work without a reward token

Finally, here are some tools and resources you can use to track the money flow and DYOR.

Best Tools

Edit description0xilluminati.com

https://cryptofees.info: Great for seeing how much a protocol is earning in fees

Token Terminal: Analytics on blockchains and protocols (https://tokenterminal.com/)

Messari: Research, Intelligence and Data about the crypto markets. (https://messari.io)

The most valuable skill in DeFi is to be able to figure out how to follow the money from its source (external revenue) to the token’s value accrual points.

I’ll write soon about how you can use various tools to follow the money. Follow me on Twitter @shivsakhuja for more, and subscribe to the 0xIlluminati newsletter.